Pay rate calculator qld

Use the transfer duty estimator to get an idea of how much duty you may have to pay or the calculator for complex calculations. For 34c per kWh enter 0.

How To Calculate Payroll Taxes For Employees Geekbooks

Given you pay Interest Only for a set term your loan balance will.

. Usage rates can be charged at a single standard rate for every block of electricity used. Find out how much stamp duty fees LMI will cost by using our home buying costs calculator. Stamp duty transfer duty is a government tax paid by the purchaser of a property in Queensland QLD.

Dont pay until youre installed and making savings. Main Residence Your main residence is exempt from capital gains tax as long as there is a dwelling on the property. QLD Stamp Duty Calculator 2022.

This field uses dollar units eg. GST Calculator or new one Percentage Calculator. This estimate is based on an average loan term over 5 years and an indicative interest rate of 1195 per annum.

Add your details. Interesting that the 308 which is a bit slower in velocity has a standard twist of 1 in 12 as does the 30-30 but they were designed to use shorter bullets. Dodo Power Gas.

Its a carry-over from the 220 gr. The Barrel Outlets Barrel Twist Calculator Calculator is a. Solar Calculator is a free.

There is no separate transfer duty rate for seniors card or pensioner concession card holders. A family member transfers property to you as a gift the property being transferred still has a dutiable value. Try our other calculators.

Sourced from the Australian Tax Office. Round nose bullet originally used for the 3003. South Australia you pay stamp duty on or before the day of settlement.

An hourly rate considers business costs and available time unlike project-based pricing which is a flat fee based on a project scope. Find out how to calculate stamp duty in QLD. Design your own solar power system in seconds with our home solar system calculator.

If you have the dollar rate per kWh from your recent bill you can enter it here and your results will be even more accurate. For example if the pay period was 06062010 to 12012017 and the pay date was 15012017 you would enter 12012017 in the calculator. Use the calculator.

Interest Only repayments are subject to credit approval. The Fair Work Ombudsman and Registered Organisations Commission Entity acknowledges the Traditional Custodians of Country throughout Australia and their continuing connection to land waters and community. Calculate the value of one currency in relation to another when you send foreign currency overseas.

Interest rate home loan term payment frequency and repayment type either principal interest or interest-only. For an accurate finance estimate please complete our finance enquiry form. We have applied the rate we feel is most accurate based on the retailer you have selected.

Often used by new businesses or to launch new products eg. Talk it through with our experts. This means that even if you pay no money for a transaction eg.

12 Months Property Ownership If you are an Australian resident and have owned the property for more than 12 months you are able to claim a 50 discount on the capital gains. Panels and batteries cut your bills VPP earns you a profit. New South Wales and Tasmania you have 3 months to pay stamp duty.

Victoria you pay stamp duty within 30 days after property transfer. NSW - VIC - QLD. Capital Growth Calculator Values.

Capital Gains Tax Calculator Values. And get paid a premium rate for your excess battery power. Electricity cost is complex and varies between retailers and consumers.

Queensland you pay stamp duty within 30 days of settlement. Average Annual Appreciation The rate of growth of value of your property as a percentage per yearAs a general guide 6 is a good starting average rate but it varies by suburb and property type. Our calculator allows you to choose repayment frequency loan term extra repayments and more.

The decision to increase rates by 05 per cent pushes the cash rate to 185 per cent. Use this pay calculator to calculate your take home pay in Australia. - This calculator provides general information only by using some generic taxation scenarios and some publicly available general material published on the ATOs.

Not more than 5000. If you choose weekly or fortnightly on the repayment calculator the amount is based on an average weekly or fortnightly figure by taking the monthly amount x 12 then dividing by 26 or 52 to provide an approximation. This is calculated in quarterly monthly or daily.

In Queensland youll pay a fixed daily supply charge cents per day to maintain infrastructure and supply power to your homeYoull also pay a usage rate based on kilowatts per hour kWh for electricity and megajoules MJ for natural gas. Additional duty of 7. Earn extra income every month while supporting your community.

PayCalc is updated every year and currently you can use pay rates to calculate net pay for previous 20212022 and current 20222023 financial years. Its the fourth time in as many months that interest rates have surged after the first increase occurred in. Enter the currency and amount youd like to convert and calculate the exchange rate and number of Australian dollars.

Salary packaging could provide you with a great way to reduce the amount of tax you pay - and get more from your salary. We explain solar feed in tariffs and help you calculate the buy back rate your retailer will pay you for the solar power you export to the grid. This means the percentage of industry rate you pay can only increase or decrease by 10 making changes predictable and easier to manage.

Hornady round nose 1269 The standard twist rate for the 3006 is 1 in 10. Riverside Centre 40123 Eagle St Brisbane City QLD 4000. Property Purchase Price The amount of money you spent to buy your house or property not accounting for inflation.

If you have only just started your job this financial year or dont want to work out your income from your group certificate then just enter 0 as the gross income shown on your. Get 3 free solar quotes. Based on exchanging time for money.

Northern Territory stamp duty is payable 60 days after settlement. Read the public ruling on residential land valuations DA5051 to learn about determining the value of land when no money is being paid for the transfer. 500 claim cost protection the first 500 of claims costs wont count towards your total claims experience.

In many cases.

Aus Processing State Payroll Taxes For Australia

How To Calculate Your Digital Agency S Charge Out Rate Sbo

How Much Should I Charge As A Consultant In Australia

Subby To Salary Calculator Boss Tradie

2

Queensland Health Hourly Pay In Australia Payscale

Calculating Holiday Pay Employees Paid In Advance

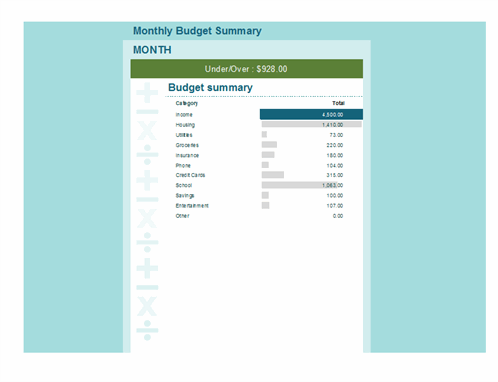

Budget Calculator

Payroll Tax Deductions Business Queensland

What Is The Minimum Wage For Your Industry Go Figured Bookkeeping

How To Calculate Your Digital Agency S Charge Out Rate Sbo

Payroll Tax The Hidden Risks Of Interstate Employees Hlb Mann Judd

Pay Calculator

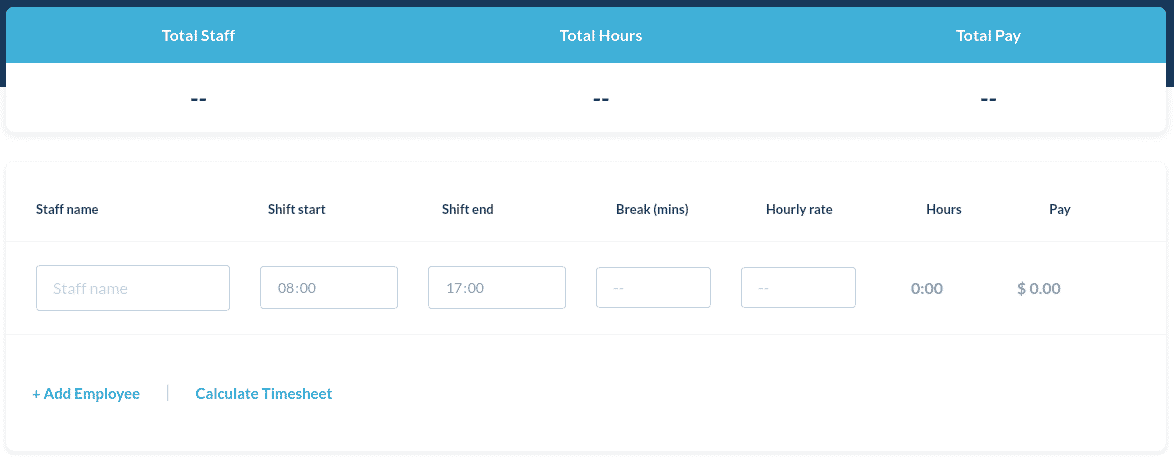

Free Timesheet Calculator For Payroll Roster Calculator Tanda Au

P A C T Pay Calculator Find Your Award V0 1 108

![]()

Salary Calculator Paying Your Employees In Australia

Aus Processing State Payroll Taxes For Australia